NUFC have released their accounts for 20/21.

The accounts include a ‘post balance sheet event’ disclosure highlighting the purchase of the club by the Public Investment Fund (PIF), PCP Capital Partners and RB Sports & Media on 7th October 2021. On that date, everything changed.

But for the moment, we’ll be taking a look at the old Newcastle. The Newcastle owned by Mike Ashley. Season 20/21 was the last of 14 depressing, soul-destroying, life draining (full) seasons that he owned the club.

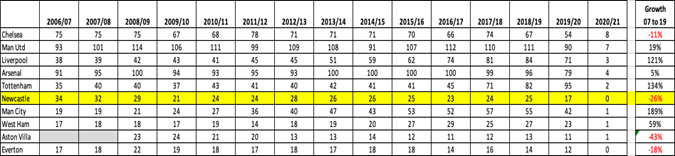

The financial results beautifully illustrate Ashley’s entire tenure at Newcastle. A club going nowhere. A club built for a perpetual relegation battle. A club falling further and further behind their competitors.

Let’s take a look.

A quick summary?

The headline figure is a ‘13.7m loss before tax.

That doesn’t sound good?

Actually, it was one of the better financial results in the Premier League that season. Only seven clubs had better financial results.

Why did so many clubs lose money?

All clubs’ income was hit by the Covid epidemic, some purportedly more than others. Three income streams ‘ Matchday, Commercial and Broadcasting ‘ let’s look at each in turn.

Ok, first up, how did Matchday income fare?

Matchday income was particularly hard hit by the epidemic. Essentially, the whole 20/21 season was played behind closed doors. Newcastle’s match day income dropped by ‘17.2m to just ‘176k.

But this doesn’t tell the whole story. I mentioned at the outset that NUFC were a club going nowhere under Ashley. When Ashley bought Newcastle, the club had a number of comparative advantages over their PL rivals. They had the third biggest stadium in England which had been completed for a relatively low cost. As a result, debt was comparatively low.

Whilst other clubs still had to go through the painful expense of redeveloping their stadiums or relocating elsewhere, this had all been done at Newcastle prior to Ashley arriving.

One of his first decisions (when he was still in his honeymoon period at NUFC) was to shelve advanced plans to redevelop the Gallowgate extending the stadium to a 63,000 capacity. This should have rung early alarm bells to supporters about Ashley’s ambitions for the club.

Since then, several other clubs have caught up and passed NUFC in terms of stadium capacity. When Everton move into their new ground, NUFC will have the 8th biggest ground in the country. The comparative advantage that Ashley inherited was squandered over 14 miserable years.

Even discounting the Covid impacted seasons, Matchday income has still not recovered to 2006/7 levels. It’s been a gradual decline in real terms but a massive decline relative to other clubs who’s match day income has increased over that period.

So that’s Matchday income. What about Commercial?

Commercial income comprises sponsorship, merchandising, conferencing etc. A similar, if not worse, story to Matchday. There are excuses for the failure to grow match day income (ticket price freeze etc). Not so Commercial revenue.

Ashley inherited a club generating Commercial revenue comparable to the top clubs in England. This is the one income stream that Ashley would have been expected to grow given his reputation, international connections and business acumen. Instead, he oversaw a collapse. The latest Commercial income figures are the latest in a long line of catastrophic results.

It is a damning indictment to the amateurism at the club during Ashley’s tenure almost tantamount to corporate sabotage. Whilst every other cited club hugely increased their commercial revenue since 2007, NUFC are unique in their almost criminal incompetence to somehow regress theirs.

Part of the problem with Commercial income under Ashley will be the exact opposite problem to that which NUFC will face under PIF. That is of owner connected sponsorship.

Clubs like Everton are trying desperately to get their owner’s wealth into their clubs under the dubious guise of commercial income. So, for example, USM Holdings (owned by Russian oligarch and Moshiri partner, Alisher Usmanov) paid Everton ’30m for the first option on the naming rights for the new stadium (to be clear, they didn’t buy the actual naming rights. Just the first option to buy the naming rights!). PIF will looking for similarly ‘creative’ solutions to increase NUFC’s commercial income.

Under Ashley however, their main advertising beneficiary, Sports Direct, didn’t put a penny into the club for 3 years (we’re told). This all lends weight to the accusations that Ashley was systematically and deliberately starving the club of income. That he had no ambition above finishing 4th bottom of the PL and using the stadium as a glorified advertising hoarding.

Finally, broadcasting?

Thankfully, broadcasting income is centrally negotiated by the Premier League rather than the NUFC leadership. Otherwise, we’d no doubt have less coming in now than we did 14 years ago. Newcastle received ‘119m in broadcasting income in 20/21.

So that’s income. What about costs?

Two main costs for any football club. Players wages and transfer fees (as reflected by player amortisation). We’ve established that income had collapsed under Ashley (relative to other clubs). And as Ashley wasn’t prepared to put in any of his own cash into the club after 2010 (other than to mitigate against the costs of relegation), NUFC were forced to cut costs to the bone to survive

In the long term, the most successful clubs are the ones that spend the most money. Not particularly a ground-breaking revelation. Stands to reason.

Whilst player wages have increased since Ashley bought Newcastle, they’ve dropped massively behind other clubs in the Premier League. This has unsurprisingly been reflected in team performance. We competed in Europe for ten of the 13 seasons prior to Mike Ashley buying the club. We’ve appeared once since. This wasn’t bad luck. It was the inevitable (some may say deliberate) outcome of the strategy followed by Ashley with spiteful vigour.

What about transfer fees?

Transfer fees are amortised over the length of a players’ contract. Essentially, amortisation figures are a good proxy measure of what clubs spend on transfer fees.

Newcastle’s amortisation in 20/21 was ‘32.3m. The 4th lowest in the Premier League (although it was impacted by the 11 month accounting period and a previous write down of player values).

I mentioned previously that Ashley’s Newcastle were set up for an annual relegation battle and this is reflected in the amortisation figures. We can see that the clubs with the lowest amortisation are the ones that are either relegated or fighting a relegation battle.

A similar story with the player squad value.

A combination of bottom third wages and bottom third squad value has equated to a club that has generally finished in the bottom third of the PL under Ashley. Try to hide your surprise.

So do we still have any debt?

The gross debt at the end of the 20/21 season was ‘112m which was ’35m more than the ’77m debt that Ashley inherited in 2007. That ’77m debt funded an entire ground redevelopment (and the transfer dealings of Graeme bloody Souness). The additional debt mitigated against the costs of Ashley’s relegations.

The club is now presumably debt free. Ashley purportedly received ‘310m for the club last October. We can assume that this included repaying Ashley his loan of ‘107m and about ‘200m for the shares. Ashley therefore made a profit of roughly ’60m (having paid c’140m in 2007). And who could begrudge him that given the phenomenal success over his tenure!

Over the last ten years, whilst other owners have been pumping eye-watering amounts of money into their clubs, Ashley has taken ’29m out of NUFC in loan repayments.

So we’ve established that Ashley not only failed to grow the club’s match day & commercial income, that Sports Direct was afforded free advertising at St. James’ Park but also that he was taking money out of the club (whilst almost every other PL club owner was putting cash into their clubs). You might now be beginning to realise why no manager worth their salt would work for him. Or with him.

How will Financial Fair Play restrict our ambitions now Ashley has gone?

The one unintended positive consequence of Ashley’s tenure was that his frugal running of NUFC has left plenty of wiggle room for a transfer splurge and still allow compliance with the profit & sustainability rules. My article on this last year provides the detail.

However, the club are keen to lower expectations. Eddie Howe has frequently cited the constraints of FFP when talking about the summer transfer plans. ‘With FFP, we have restraints. We can’t just go out and spend money on players like maybe teams could have done in the past.’

Why is that if there’s plenty of ‘wiggle room’?

A number of reasons.

Firstly, FFP compliance is assessed over three years (allowable losses over that period are ‘105m). If the club was to ‘front-load’ a huge transfer splurge (and financial loss) in their first year then it would leave very little ‘wiggle room’ for years 2 and 3 in the assessment period. Everton are the obvious example of this ‘front-loading’ and are suffering the consequences for that now.

Secondly, the cub will be wary of provoking other PL clubs who are already looking to rush in new rules around fair value of sponsorship deals aimed specifically at Newcastle.

Thirdly, it would be spectacularly stupid to alert clubs that NUFC have a boatload of money to burn in the transfer market. Nothing will guarantee more that transfer targets’ prices will be inflated.

And finally, to manage supporters’ expectations. According to the media, NUFC supporters’ were expecting Mbappe and Messi to arrive at St. James’ Park. Nonsense of course but still worth reiterating.

So how does the future look?

NUFC won’t sign Mbappe or Messi. But neither will they be bringing in the next Jeff Hendrick. No matter what the constraints on the club, the future is a hell of a lot brighter than it has been for 14 years.

‘Andrew Trobe – @TFAndy1892’